Munis were steady Monday ahead of a large new-issue calendar, while U.S. Treasuries were weaker and equities ended mixed.

Munis continue to see strong demand for bonds over the past several weeks, which has “pushed munis to be richer on a relative value basis versus Treasuries,” said Jason Wong, vice president of municipals at AmeriVet Securities.

The two-year muni-to-Treasury ratio Monday was at 60%, the three-year at 59%, the five-year at 59%, the 10-year at 58% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 61%, the three-year at 60%, the five-year at 59%, the 10-year at 60% and the 30-year at 83% at 3:30 p.m.

“Despite the reduced reinvestment cash that hit accounts in the beginning of the month along with relatively unattractive valuations, robust fund flows and already high cash balances helped keep muni investors engaged,” said Birch Creek Capital strategists.

The AAA Refinitiv MMD curve fell two to six basis points “amidst a muted secondary market as most investors seem content to focus exclusively on new issues,” Birch Creek noted.

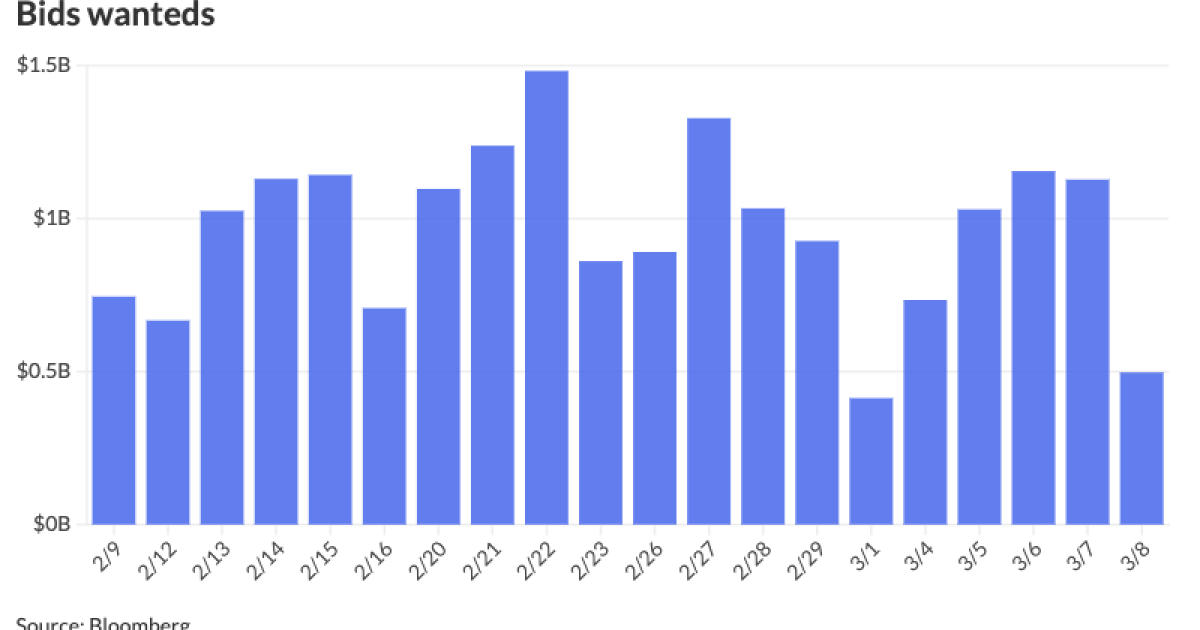

One of the “few active adders” were

Issuers have

This can be seen by last week’s “the New York City [Municipal Water Finance Authority] issue which increased the size of the issuance by $600 million,” Wong said.

Yields have been lowered due to “high demand” for munis as the Harvard issuance was bumped by 18 basis points from initial pre-marketing for their taxable issue, he said.

For Harvard’s taxable issue, spreads were as low as -36 in the front end, according to Wong.

Investors “are looking to lock-in the higher yields being offered today ahead of any Fed rate cuts that may come down the line this year,” he noted.

This week’s $9.1 billion of issuance “may help to pare down some of the excess, but unless a sudden jump in interest rates derails the fund flow momentum, the muni market is unlikely to cheapen much in the near term,” Birch Creek strategists said

“The seasonally weak month of March could end up being a red herring given that investors have sufficient cash to put to work,” said Vikram Rai, head of municipal markets strategy at Wells Fargo.

This is especially evidenced by the latest Fed funds report which shows that the retail cash and cash equivalents have increased by a startling $4.7 trillion since pre-pandemic though it has held almost steady [year-over-year],” he said.

On the other hand, the allocation to munis increased by 9% in 2023 year-over-year.

This “expectation is contingent upon a stable rates environment which is far from a foregone conclusion given material events,” including this week’s Consumer Price Index report and the March Federal Open Market Committee meeting, he said.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.95% and 2.71% in two years. The five-year was at 2.40% (unch), the 10-year at 2.40% and the 30-year at 3.57% at 3 p.m.

The ICE AAA yield curve was little changed: 2.97% (unch) in 2025 and 2.74% (unch) in 2026. The five-year was at 2.41% (-1), the 10-year was at 2.43% (unch) and the 30-year was at 3.51% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 2.93% in 2025 and 2.71% in 2026. The five-year was at 2.40%, the 10-year was at 2.40% and the 30-year yield was at 3.54%, according to a 3 p.m. read.

Bloomberg BVAL was unchanged: 2.91% in 2025 and 2.76% in 2026. The five-year at 2.38%, the 10-year at 2.44% and the 30-year at 3.59% at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.533% (+5), the three-year was at 4.295% (+4), the five-year at 4.086% (+3), the 10-year at 4.097% (+1), the 20-year at 4.359% (flat) and the 30-year at 4.262% (flat) at 3:30 p.m.

Primary to come:

The Dormitory Authority of the State of New York (Aa1//AA+/AA+) is set to price Wednesday $2.985 billion of general-purpose state personal income tax revenue bonds, consisting of $2.845 billion of tax-exempts, Series 2024A, and $140.685 million of taxables, Series 2024B. RBC Capital Markets.

CommonSpirit Health (A3/A-/A-/) is set to price Wednesday $1.737 billion of taxable corporate CUSIPs, Series 2024A; $775.270 million of revenue bonds, Series 2024, through the Colorado Health Facilities Authority; and $246.565 million of revenue bonds, Series 2024, through the California Health Facilities Financing Authority. Morgan Stanley.

The Black Belt Energy Gas District (A1///) is set to price Tuesday $579.075 million of gas project revenue bonds, 2024 Series A. Goldman Sachs.

The Los Angeles Department of Water and Power (Aa2/AA-//AA/) of is set to price Wednesday $352,045 million of power system revenue refunding bonds, 2024 Series A, serials 2024-2044. Siebert Williams Shank & Co.

The Idaho Housing and Finance Association (Aa1//AA+/) is set to price Thursday $331.510 million of Transportation Expansion and Congestion Mitigation Fund sales tax revenue bonds, Series 2024A. J.P. Morgan.

Williamson County, Texas, (/AAA/AAA/) is set to price Wednesday $327 million, consisting of $160 million of Unlimited Tax Road Bonds, Series 2024, and $167 million of limited tax notes, Series 2024. Jefferies.

Clark County, Nevada, (Aa2//AA-/AA-/) is set to price Wednesday $322.100 million of non-AMT airport system subordinate lien refunding revenue bonds, Series 2024A, serials 2025-2032. BofA Securities.

The county (Aa3//AA-/A+) is also set to price Wednesday $152.225 million of non-AMT airport system junior subordinate lien revenue notes, Series 2024B, serial 2029. RBC Capital Markets.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price Tuesday $250 million of residential mortgage revenue bonds, consisting of $150 million of non-AMT bonds, Series 2024A, serials 2025-2035, terms 2039, 2044, 2049, 2054, 2054; and $100 million of taxables, Series 2024B, serials 2025-2032, terms 2039, 2044, 2047, 2054. RBC Capital Markets.

The Ohio Housing Finance Agency is set to price Wednesday $200 million of non-AMT social Mortgage-Backed Securities Program residential mortgage revenue bonds, 2024 Series A. J.P. Morgan.

The California Health Facilities Financing Authority (/AA-/AA-/) is set to price Tuesday $182.250 million of Children’s Hospital of Orange County revenue bonds, consisting of $72.155 million of Series 2024A and $110.095 million of Series 2024B. Morgan Stanley.

The Cass County Joint Water Resource District, North Dakota, (Aa3///) is set to price Tuesday $180 million of temporary refunding improvement bonds, Series 2024A. Colliers Securities.

Ohio (Aaa/AAA/AAA/) is set to price Tuesday $175.125 million of infrastructure improvement GOs, Series 2024A, serials 2025-2043. KeyBanc Capital Markets.

The Public Finance Authority, Wisconsin, is set to price Wednesday $167.810 million of special revenue bonds, Series 2024. Piper Sandler.

The Virginia Housing Development Authority (Aaa/AAA//) is set to price Tuesday $160 million of taxable commonwealth mortgage bonds, 2024 Series A, serials 2025-2033, terms 2039, 2044, 2049, 2054. Raymond James.

Fairfax County, Virginia, (Aaa/AAA/AAA/)is set to price Thursday $124.135 million of sewer revenue bonds, Series 2024A. Morgan Stanley.

The Cahokia Unit School District No. 187, Illinois, (/AA//) is set to price Tuesday $123.110 million of Assured Guaranty-insured bonds, consisting of $73.110 million of Series A, serials 2025-2044, terms 2049, 2054; $25 million of Series B, serials 2035-2044; and $25 million of Series C, serial 2028-2035. Oppenheimer.

The Louisiana Housing Corp. (Aaa///) is set to price Thursday $110 million of Home Ownership Program single family mortgage revenue bonds, $100 million of non-AMT bonds, Series 2024A, and $10 million of taxables, Series 2024B. Raymond James.

The Louisiana Local Government Environmental Facilities and Community Development Authority (Aaa///) is set to price Wednesday $104 million of American Biocarbon CT Project revenue bonds, consisting of Series 2021 and Series 2023.Jefferies.

The California Municipal Finance Authority (/BBB+//) is set to price Thursday $100 million of Republic Services Project solid waste disposal revenue bonds, Series 2024A, serial 2054. BofA Securities.

Competitive

Henrico County, Virginia, (Aaa/AAA/AAA/) is set to sell $121.355 million of GO public improvement bonds, Series 2024A, at 10:30 a.m. eastern Tuesday.