Municipals were slightly better on the short end Friday, reversing some of Thursday’s losses, while U.S. Treasuries made small gains across the curve and equities were up near the close.

Triple-A yields closed out the week on better footing by one to three basis points, albeit in light secondary trading, ahead of a much larger new-issue calendar.

The total potential volume for next week is estimated at $11.748 billion, up from $7.4 billion this week. There are $10.034 billion of negotiated deals on tap and $1.713 billion on the competitive slate. Bond Buyer 30-day visible supply sits at $15.06 billion.

Tax-exempt supply returns to the $10 billion pace the market has seen “in every non-Fed and non-CPI week since May, against a backdrop of broadly supportive fund flows (inflows for seven consecutive weeks), somewhat better dealer positions (although still heavy), and mid-August reinvestment to spend,” noted J.P. Morgan strategists, led by Peter DeGroot. “On net, with the expectation of persistent supply pressure and continued rate volatility, day-to-day and week-to-week market conditions are expected to be highly dependent on ETF flows (driven by rate volatility) and the level of reinvestment capital.”

The largest deals of the week come from New York City with $1.8 billion of exempt and taxable general obligation bonds, the Hillsborough County Industrial Development Authority, North Carolina, with $1.302 billion of BayCare Health System revenue refunding bonds and $713.41 million of Dallas Fort Worth International Airport non-AMT joint revenue refunding and improvement bonds.

The market has been “rather capricious,” noted Barclays PLC in a weekly report, pointing out that just two weeks ago, after soft payrolls, “investors got really concerned that the U.S. economy was falling into recession and ratcheted up their expectations about the timing and pace of rate cuts, including a fully priced in 50bp cut in September.”

A combination of stronger retail sales, lower jobless claims and softer inflation prints this week have tempered their expectations and reassured market participants, Barclays strategists Mikhail Foux and Clare Pickering wrote. “Now, a 25 basis point rate cut next month and the Fed’s ability to stave off recession again seem to be the base case.”

The more upbeat economic data releases this week resulted in “more measured expectations about the pace of rate hikes,” leading the UST yield curve to invert slightly, they said.

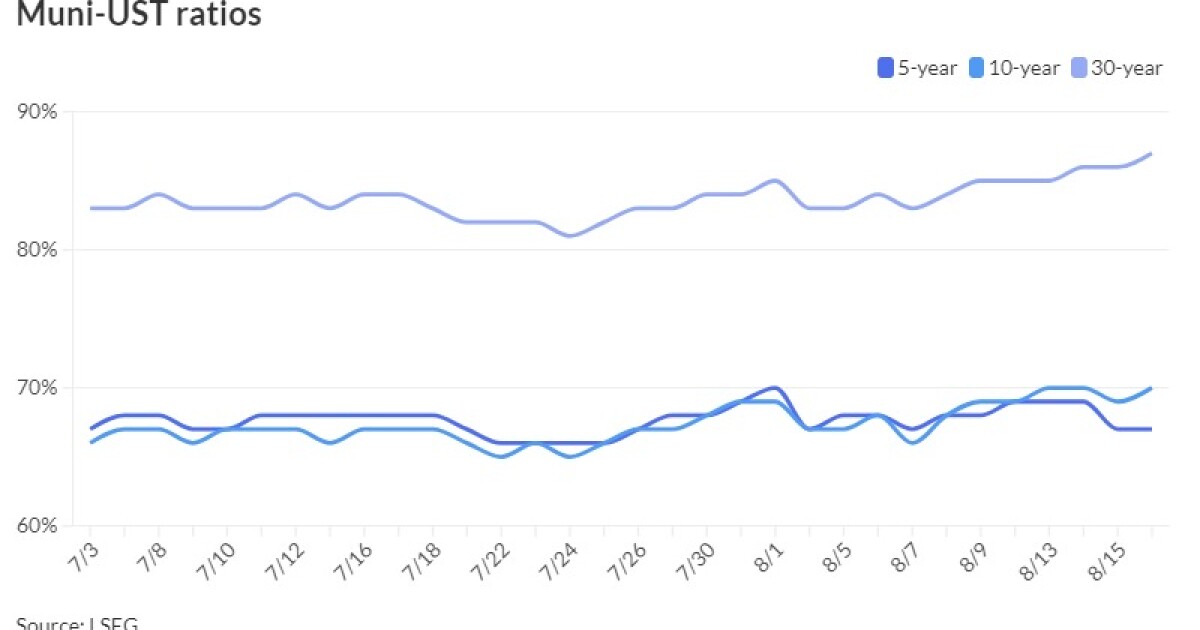

“Muni ratios have continued to drift higher after reaching their lows last week. MMD-UST ratio have already widened 2-3pp since May, proving yet again that tax-exempts typically underperform Treasuries in summer despite heavy redemptions,” Foux and Pickering said.

Muni to UST ratios were lower on the short end Friday, with the two-year muni-to-Treasury ratio at 63%, the three-year at 66%, the five-year at 67%, the 10-year at 70% and the 30-year at 87%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 67%, the 10-year at 69% and the 30-year at 86% at 3 p.m.

“Investors will be closely monitoring the upcoming data releases, and the market will likely remain quite volatile,” Barclays PLC said.

Barclays rate strategists believe the 10-year part of the Treasury curve has room to cheapen. “In that case, tax-exempts will likely not only follow, but underperform,” Foux and Pickering said. “As before, we remain cautious and will look for more attractive opportunities in early autumn.”

AAA scales

Refinitiv MMD’s scale was bumped two to three basis points: The one-year was at 2.64% (-3) and 2.58% (-3) in two years. The five-year was at 2.54% (-2), the 10-year at 2.71% (unch) and the 30-year at 3.59% (unch) at 3 p.m.

The ICE AAA yield curve was little changed: 2.68% (+3) in 2025 and 2.64% (+4) in 2026. The five-year was at 2.57% (+4), the 10-year was at 2.71% (+4) and the 30-year was at 3.58% (+4) at 4 p.m.

The S&P Global Market Intelligence municipal curve was better: The one-year was at 2.70% (unch) in 2025 and 2.65% (-3) in 2026. The five-year was at 2.55% (-3), the 10-year was at 2.70% (unch) and the 30-year yield was at 3.56% (unch) at 4 p.m.

Bloomberg BVAL was little changed: 2.67% (unch) in 2025 and 2.64% (unch) in 2026. The five-year at 2.58% (unch), the 10-year at 2.64% (-1) and the 30-year at 3.56% (-1) at 4 p.m.

Treasuries improved.

The two-year UST was yielding 4.05% (-5), the three-year was at 3.864% (-4), the five-year at 3.764% (-4), the 10-year at 3.88% (-4), the 20-year at 4.258% (-3) and the 30-year at 4.15% (-3) near the close.

Primary to come

New York City (Aa2/AA/AA/AA+) is set to price Wednesday $1.5 billion of general obligation bonds, serials 2026-2031, 2037-2049, term 2052. Loop Capital Markets.

The Hillsborough County Industrial Development Authority, North Carolina, is set to price Wednesday $1.302 billion of BayCare Health System revenue refunding bonds. Morgan Stanley & Co. LLC

Dallas and Fort Worth, Texas, (A1/AA-/A+/AA) are set to price Thursday $713.41 million of Dallas Fort Worth International Airport non-AMT joint revenue refunding and improvement bonds, serials 2028-2044, term 2049. Wells Fargo Bank, N.A. Municipal Finance Group.

Los Angeles County Public Works Financing Authority (/AA+/AA+/) is set to price Thursday $576.11 million of lease revenue bonds, serials 2024-2044, terms 2049, 2053. BofA Securities.

The Atlanta Development Authority is set to price Tuesday $556.11 million consisting of $356.110 million of Convertible Capital Appreciation Economic Development Certificates (Gulch Enterprise Zone Project) and $200 million senior revenue bonds (Westside Gulch Area Project). J.P. Morgan Securities LLC.

Louisiana (Aa2/AA//AA) is set to price Tuesday $464.02 million GO refunding bonds consisting of $89.760 million Series 2024C, serials 2024-2034; $22.375 million Series 2024D, serials 2024-2034; $160.77 million Series 2024E, serials 2024-2036; and $191.115 million of Series 2025A (forward delivery) serials 2025-2035. Raymond James & Associates, Inc.

The Allegheny County Sanitary Authority (Aa3/AA-//) is on the day-to-day calendar with $361.595 million sewer revenue refunding bonds, Series 2024, serials 2024-2044, terms 2049, 2055. PNC Capital Markets LLC.

San Antonio, Texas, (Aaa/AAA/AA+/) is set to price Tuesday $357.38 million, consisting of $177.13 million of general improvement bonds, $124.85 million of combination tax and revenue certificates of obligation, and $55.4 million of tax notes. Piper Sandler & Co.

The Illinois Finance Authority is on the day-to-day calendar with $281.02 million of Endeavor Health Credit Group revenue refunding bonds (Aa3/AA-//), serials 2030, 2034. BofA Securities.

The Kenton County Airport Board, Kentucky, (A1//A+/) is set to price Tuesday $273.535 million of Cincinnati/Northern Kentucky International Airport revenue bonds consisting of $258.760 million of AMT bonds, serials 2029-2044, terms 2049, 2054; and $14.775 million of Series 2024B, serials 2026-2044, terms 2049, 2054. BofA Securities.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price Wednesday $250 million of homeownership mortgage bonds, consisting of $200 million of non-AMT bonds, serials 2029-2030, 2036 and terms 2039, 2044, 2049, 2055; and $50 million of taxables, serials 2025-203. Wells Fargo Bank, N.A. Municipal Finance Group.

The Nevada Housing Division (/AA+//) is set to price Wednesday $220.525 million of single-family mortgage revenue bonds, consisting of $172.855 million of senior taxable bonds and $47.67 million of senior non-AMT bonds. J.P. Morgan Securities LLC.

The New York State Environmental Facilities Corp. (Aaa/AAA/AAA/) is set to price Tuesday $218.84 million of 2010 Master Financing Program green state revolving funds revenue bonds Series 2024 B, serials 2024-2037, 2044, terms 2038, 2039, 2040, 2041, 2042, 2043. Siebert Williams Shank & Co., LLC.

The Cabarrus County Development Corp., North Carolina, (Aa1/AA+/AA+/) is on the day-to-day calendar with $204.63 million of limited obligation refunding bonds, serials 2025-2044. BofA Securities.

The Public Utility District No. 2 of Grant County, Washington, (/AA/AA/) is set to price Wednesday $164.675 million of Priest Rapids Hydroelectric Project revenue refunding bonds. J.P. Morgan Securities LLC.

The Mabank Independent School District, Texas, (/AAA/AAA/) is set to price Thursday $117.97 million of unlimited tax school building and refunding bonds, PSF Insured. FHN Financial Capital Markets.

Competitive

The South Dakota Conservation District (Aaa/AAA//) is set to sell $162.555 million of state revolving fund program bonds at 11:15 a.m. eastern Tuesday.

New York City is set to sell $300 million of taxable GOs at 10:45 a.m. Wednesday.

The North Texas Municipal Water District (Aa1/AAA//) is set to sell $153.705 million of Upper East Fork Wastewater Interceptor System Contract revenue refunding and improvement bonds at 11:30 a.m. eastern Wednesday.