Municipals were little changed in secondary trading Tuesday as the busy primary market took focus, led by two billion-dollar-plus deals from the Texas Transportation Commission and South Carolina Public Service Authority. U.S. Treasuries were firmer and equities were up toward the close.

The two-year muni-to-Treasury ratio Tuesday was at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 66% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 66% and the 30-year at 82% at 3:30 p.m.

Election uncertainty continues to cast a dark cloud over the market. With President Joe Biden not seeking reelection, Vice President Kamala Harris reportedly has the support of enough delegates to be the Democrats’.

Biden’s withdrawal from the presidential election “may compel a more neutral positioning in the near term, but it is a safe assumption that whoever wins, UST supply will see upward pressure,” said Matt Fabian, a partner at Municipal Market Analytics.

Election uncertainty has gained even more traction over the past week, observers said.

“Investors are likely going to have to rely more on the running yields their bonds generate rather than excess price appreciation for the remainder of the year,” Birch Creek strategists said.

Political headlines have had little impact on munis beyond

While triple-A benchmark yields were steady Tuesday, muni yields have fallen an average of 33 basis points since the start of June,” said Jason Wong, vice president of municipals at AmeriVet Securities, a “good” start for the summer.

“The front end of the curve is showing the strongest gains as yields fell by an average of 36 basis points, the belly of the curve falling by an average of 30 basis points, and the long end by 25 basis points,” he noted.

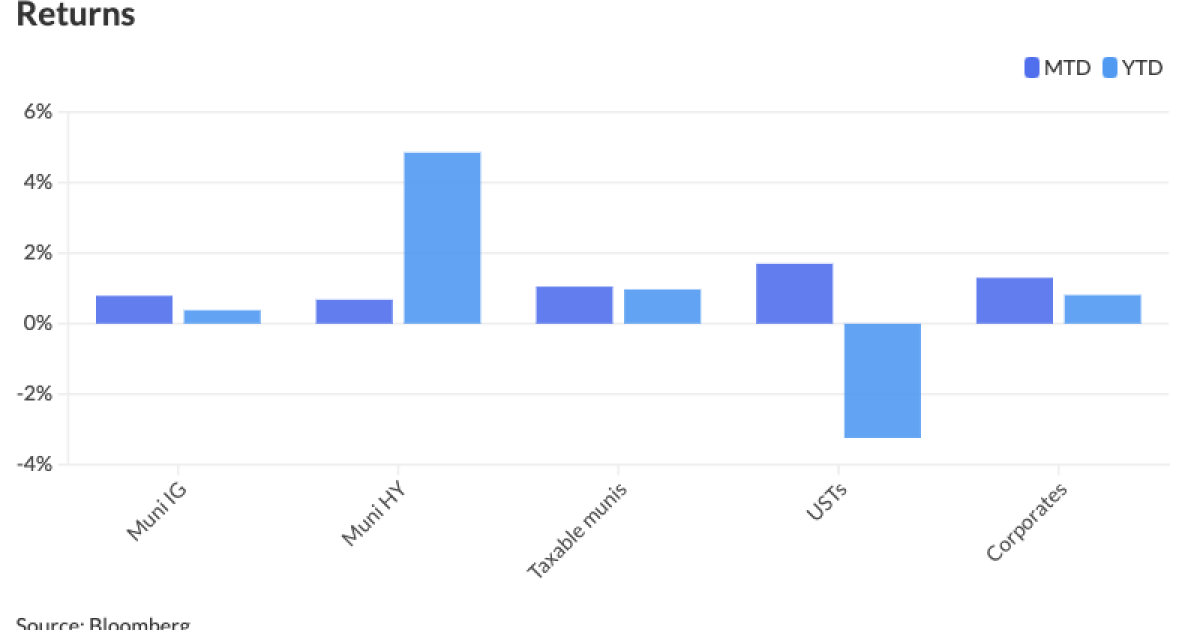

With the rally in July, munis have pushed “further into the green” with a year-to-date return of 0.38% and a month-to-date return of 0.79%, Wong said.

“Currently, we are about half a point above where we started at the beginning of this year,” he said. “We could see yields move closer to positive levels as the Fed meets later this month, which will give us a better understanding of when the Fed will cut rates.”

This week again sees elevated supply, as issuance sits at $9.673 billion, with Tuesday being a very busy day.

In the primary market, Wells Fargo priced and repriced for the Texas Transportation Commission $1.413 billion of Central Texas Turnpike System revenue refunding bonds, with yields bumped up to 10 basis points out long from the preliminary pricing. The first tranche, $387.555 million of first-tier bonds, Series 2024-A (A2/A/A+/), saw 5s of 8/2032 at 3.22% (-5), 5s of 2035 at 3.36% (unch) and 5s of 2038 at 3.50% (-1), callable 8/15/2034.

The second tranche, $1.026 billion of second-tier bonds, Series 2024-C (A3/A-/A-/), saw 5s of 8/2031 at 3.33% (-4), 5s of 2034 at 3.42% (unch), 5s of 2039 at 3.65% (-5) and 5s of 2042 at 3.85% (-10), callable 8/15/2034.

Morgan Stanley priced for the commission (A2/A/A+/) $225 million of Central Texas Turnpike System first-tier revenue refunding put bonds, Series 2024B, with 5s of 8/2042 with a mandatory tender data of 8/15/2030 at 3.44%, callable 5/15/2030.

J.P. Morgan priced for the South Carolina Public Service Authority (A3/A-/A-/) $1.237 million of tax-exempt revenue obligation bonds. The first tranche, $372 million of improvement bonds, Series 2024 A, saw 5s of 12/2026 at 3.17%, 5s of 2029 at 3.19%, 5s of 2034 at 3.39%, 5s of 2039 at 3.65%, 5s of 2044 at 4.08%, 5.25s of 2049 at 4.24% and 5.5s of 2054 at 4.23%, callable 12/1/2034.

The second tranche, $865.085 million of refunding bonds, Series 2024B, saw 5s of 12/2032 at 3.34%, 5s of 2034 at 3.39%, 5s of 2039 at 3.65%, 4.125s of 2044 at 4.28%, 5s of 2049 at 4.31%, 5s of 2049 at 4.16% (Assured Guaranty-insured), 5.25s of 2054 at 4.34% and 5s of 2054 at 4.24% (Assured Guaranty-insured), callable 12/1/2034.

Goldman Sachs priced for Wisconsin (Aa1/AA+//AAA/) $555.695 million of GO refunding bonds. The first tranche, $301.575 million of Series 2024-2, saw 5s of 5/2025 at 2.99%, 5s of 2029 at 2.84 and 5s of 2034 at 2.96%, noncall.

The second tranche, $254.12 million of forward-delivery bonds, Series 2025-2, saw 5s of 5/2026 at 3.24%, 5s of 2029 at 3.11% and 5s of 2038 at 3.29%, callable 5/1/2035.

Siebert Williams Shank held a one-day retail order for the San Diego Public Facilities Financing Authority’s (/AA/AA/) $267.9 million of subordinated sewer revenue bonds, Series 2024A, with 5s of 5/2025 at 2.78%, 5s of 2029 at 2.68%, 5s of 2034 at 2.78%, 5s of 2039 at 3.07%, 5s of 2044 at 3.44%, 5s of 2049 at 3.66% and 5s of 2054 at 3.76%, callable 5/15/2034.

BofA Securities priced for the Hampton Roads Sanitation District, Virginia, (Aa1/AA+//) $241.045 million of wastewater revenue bonds, Series 2024B, with 5s of 7/2039 at 3.18%, 5s of 2044 at 3.58%, 5s of 2049 at 3.80% and 5s of 2054 at 3.90%, callable 7/1/2034.

BofA Securities priced for the Cleveland Health and Educational Facilities Board, Tennessee, (/A+//) $201.865 million of Hamilton Health Care System revenue bonds, Series 2024A, with 5s of 8/2029 at 3.11%, 5s of 2034 at 3.28%, 5s of 2039 at 3.54%, 5s of 2044 at 3.91%, 5s of 2049 at 4.16%, 4.25s of 2054 at 4.49% and 5.25s of 2054 at 4.24%, callable 8/15/2034.

Oppenheimer priced for the Longview Independent School District, Texas, (Aaa//AAA/) $190 million of PSF-insured unlimited tax school building bonds, Series 2024, with 5s of 2/2025 at 3.00%, 5s of 2029 at 2.87%, 5s of 2034 at 3.05%, 5s of 2039 at 3.31%, 5s of 2044 at 3.66% and 4s of 2049 at 4.20%, callable 8/15/2034.

Piper Sandler priced and repriced for the Elgin Independent School District, Texas, (Aaa/AAA//) $142.065 million of PSF-insured unlimited tax school building bonds, Series 2024, with yields cut six basis points out long from the preliminary pricing: 5s of 8/2028 at 2.96% (unch), 5s of 2029 at 2.92% (-3), 5s of 2034 at 3.07% (unch), 5s of 2039 at 3.31% (unch), 5s of 2044 at 3.68% (unch), 4s of 2049 at 4.27% (+6) and 5s of 2054 at 4.06% (+6), callable 8/1/2034.

Raymond James priced for the Oklahoma Water Resources Board (/AAA/AAA/) $130 million of Clean Water Program Revolving Fund revenue bonds, Series 2024, with 5s of 4/2026 at 2.90%, 5s of 2029 at 2.84%, 5s of 2034 at 2.93%, 5s of 2039 at 3.20%, 5s of 2044 at 3.56% and 5s of 2049 at 3.80%, callable 4/1/2034.

In the competitive market, Connecticut (Aa3/AA-/AA-/) sold $223.365 million of GO refunding bonds, Series 2024 E, to Wells Fargo, with 5s of 9/2025 at 2.90%, 5s of 2029 at 2.83% and 5s of 2034 at 2.93%, noncall.

The Virginia Residential Authority (Aa1/AA/) sold $122.23 million of infrastructure revenue bonds for the Virginia Pooled Financing Program, Series 2024B, to BofA Securities, with 5s of 11/2024 at 2.85%, 5s of 2029 at 2.81%, 5s of 2034 at 2.86%, 5s of 2039 at 3.16%, 4s of 2044 at 3.90%, 4s of 2049 at 4.13% and 4s of 2054 at 4.18%, callable 11/1/2034.

Issuance sits at $258.871 billion year-to-date, with several large deals already on the calendar in the coming weeks, according to LSEG data.

With “the pace of new supply not slowing down, it seems to be keeping significant market gains at bay,” Birch Creek strategists said.

The “record pace” of issuance “has not yet been a problem for investors, due to persistent [separately managed account] demand and emergent mutual fund flows,” Fabian said.

SMAs were buying last week, which ended with over 250,000 trades, he said.

This volume occurred “despite Friday’s slump to the second-slowest trading day of the year, inclusive even of half days,” he said, noting this could be connected to the Cloudstrike IT outage.

Last week, saw the largest inflows into muni funds since May, according to Wong.

LSEG Lipper data shows investors added

“Muni bond fund inflows continue to show that investors are gaining confidence in the muni markets as we anticipate a potential rate cut in September,” Wong said.

Fabian credits this “strong week” for mutual fund and ETF inflows to long-duration and high-yield strategies.

“Such will continue if the Fed becomes more apt to cut in September; however, a stronger bid from mutual funds might well act as a replacement for, rather than a comment to, SMA demand if higher prices erode coupon income levels too quickly,” he said.

“Any UST rally is very likely to mean municipal underperformance, while UST weakness, may more prominently center SMAs as the marginal demand component,” Fabian added.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.88% and 2.85% in two years. The five-year was at 2.75%, the 10-year at 2.78% and the 30-year at 3.66% at 3 p.m.

The ICE AAA yield curve was little changed: 2.90% (unch) in 2025 and 2.88% (unch) in 2026. The five-year was at 2.77% (unch), the 10-year was at 2.81% (+1) and the 30-year was at 3.66% (unch) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 2.91% (-1) in 2025 and 2.88% (-1) in 2026. The five-year was at 2.78% (unch), the 10-year was at 2.80% (unch) and the 30-year yield was at 3.64% (unch) at 3 p.m.

Bloomberg BVAL was unchanged: 2.94% in 2025 and 2.88% in 2026. The five-year at 2.80%, the 10-year at 2.78% and the 30-year at 3.67% at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.484% (-4), the three-year was at 4.263% (-3), the five-year at 4.153% (-2), the 10-year at 4.242% (-1), the 20-year at 4.567% (-1) and the 30-year at 4.474% (flat) at 3:30 p.m.

Primary to come

The Minneapolis-St. Paul Metropolitan Airports Commission (/A+/A+/) is set to price Wednesday $693.8 million of subordinate airport revenue bonds, consisting of $208.23 million of governmental/non-AMT bonds, Series 2024A, term 2054; and $485.66 million of private activity/AMT bonds, serials 2026-2044, term 2049. Wells Fargo.

The Black Belt Energy Gas District is set to price $600 million of gas project revenue bonds, 2024 Series C. Goldman Sachs.

The Pennsylvania Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $491.115 million of single-family mortgage revenue bonds, consisting of $339.3 million on non-AMT social bonds, Series 2024-146A, serials 2034-2036, terms 2039, 2044, 2049, 2053, 2054; $75.69 million of taxables, Series 2024-146B, serials 2025-2034, terms 2039,2043; and $80.125 million of taxables, Series 2024-146C, serials 2025-2034, terms 2039, 2044, 2049, 2053, 2054 BofA Securities.

King County, Washington, (Aa1/AA+//) is set to price Wednesday $300 million of sewer revenue refunding bonds, 2024 Series A. BofA Securities.

The National Finance Authority, New Hampshire, (A2///) is set to price Wednesday $266.112 million of social municipal certificates, Series 2024-3, Class A, serial 2041. Wells Fargo.

Galveston, Texas, (/A/A-/) is set to price Thursday $160 million of Wharves and Terminal first lien revenue bonds, consisting of $111.525 million of Series 2024A, and $48.475 million of Series 2024B. Piper Sandler & Co.

The South Carolina Jobs Economic Development Authority (/AA/AA-/) is set to price Thursday $141.13 million of McLeod Health Project healthcare revenue refunding bonds, Series 2024. J.P. Morgan.

The State of New York Mortgage Agency (Aa1///) is set to price Wednesday $140 million of social homeowner mortgage revenue bonds, consisting of $89.975 million of non-AMT bonds, Series 261, terms 2039, 2044, 2049, 2054; $30.025 million of AMT bonds, Series 262, serials 2025-2036; and $20 million of taxables, Series 263, term 2054. Ramirez.

Lakeland, Florida, (A2///) is set to price Wednesday $138.14 million of fixed-mode Lakeland Regional Health System hospital revenue refunding bonds, Series 2024. J.P. Morgan.

The Michigan Finance Authority is set to price Tuesday $127.23 million of state aid revenue notes, consisting of $62.31 million of Series 24A-1, and $64.92 million of Series 24A-2. J.P. Morgan.

The Wisconsin Public Finance Authority (Aa3///) is set to price Thursday $120 million of tax-exempt pooled securities, Series 2024-2, Class A certificates. J.P. Morgan.

Competitive

Richmond, Virginia, is set to sell $124.43 million of GO public improvement bonds, Series 2024C, at 10:30 a.m. Eastern Wednesday.