Municipals were mixed Thursday, while U.S. Treasuries were firmer five years and out and equities ended mixed after data showed the economy grew at a hotter-than-expected pace in the second quarter.

“News that U.S. economic growth accelerated faster than expected in the second quarter has sent market participants on a roller-coaster ride,” said José Torres, senior economist at Interactive Brokers. “Indeed, stocks, bonds, and the greenback alike have moved quite violently, swinging from sharp losses to notable gains in the first few hours of trading.”

Questions about consumer health, raised in many earnings calls, has “influenced investor behavior,” he added, as the market priced in three consecutive Fed rate cuts starting in September. “But not so fast: ladies and gentlemen, my outlook for July and August inflation reflects price pressures rising well above the central bank’s target, enabling the committee to wait until December to reduce the cost of capital,” Torres said.

Despite munis being mixed Thursday, the muni AAA yield curve remains inverted, said Taylor Huffman, a client portfolio manager at PTAM.

Historically, an inversion of the UST yield curve does not mean an inversion of the muni AAA yield curve as well, she noted.

The reason for the inversion — and why it persists — is due, in part, to muni investors waiting to see what the Federal Reserve does and when it does it, Huffman said.

Separately managed accounts, which tend to build bond ladders, also play a role, she said.

“Those constraints within maturity preferences of these [SMA] ladders could certainly have a strong influence” on the shape of the muni AAA yield curve, according to Huffman.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 66% and the 30-year at 82%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 66%, the 10-year at 66% and the 30-year at 81% at 3:30 p.m.

Muni-UST ratios have “cheapened modestly” over the past several months, particularly five- to 10-year ratios, Huffman said.

However, she noted, ratios are still “expensive” relative to historical medians.

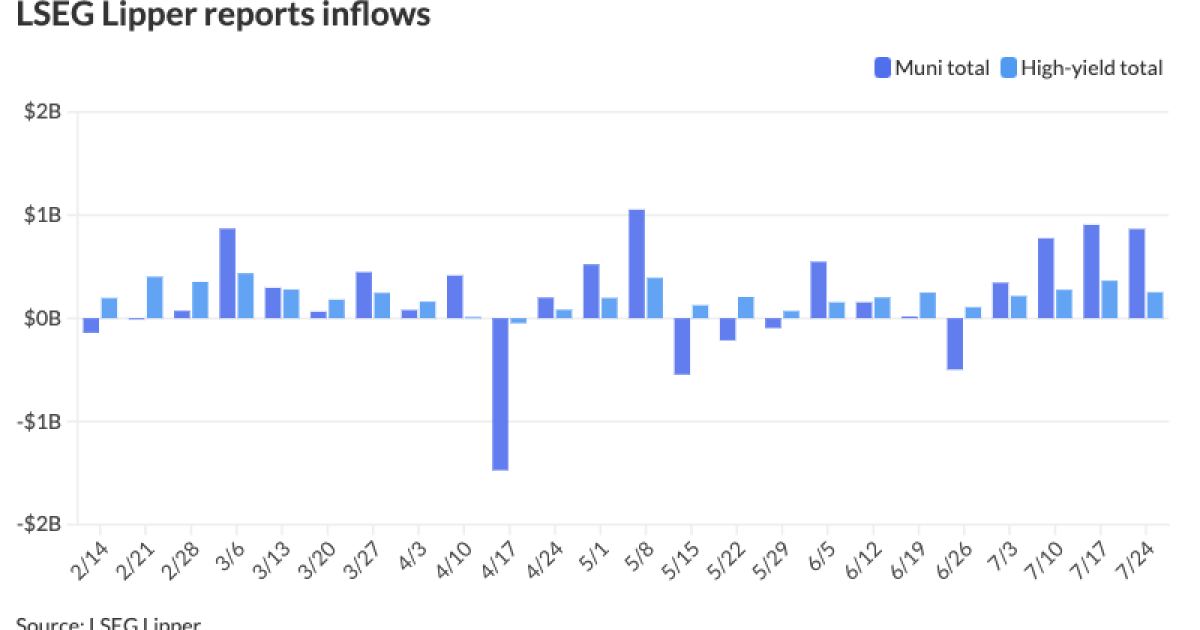

Inflows into muni mutual funds continued, marking four consecutive weeks of positive flows.

Municipal bond mutual funds saw inflows as investors added $865.7 million to funds after

The number of weeks of inflows into mutual funds year-to-date is greater than the entirety of 2023, Huffman said.

“The trends in terms of flows are advocating for more exposure to municipal bonds or fixed-income,” she said.

The past several weeks have seen an elevated calendar of around $10 billion, with the deals “well absorbed,” Huffman said.

Issuance was particularly busy Tuesday and Wednesday but slowed Thursday.

In the primary market, Morgan Stanley priced for Brightline West $1 billion of non-rated passenger rail project revenue bonds — $850 million through the California Infrastructure and Economic Development Bank and $150 million through the Nevada Department of Business and Industry.

Piper Sandler priced for Galveston, Texas, (/A/A-/) $156.835 million of

The second tranche, $50.71 million of Series 2024B, saw 5s of 8/2026 at 3.35%, 5s of 2029 at 3.30%, 5s of 2034 at 3.50%, 5s of 2039 at 3.74% and 5.25s of 2044 at 4.04%, callable 8/1/2033.

J.P. Morgan priced for the South Carolina Jobs Economic Development Authority (/AA/AA-/) $143.17 million of McLeod Health Project healthcare revenue refunding bonds, Series 2024, with 5s of 11/2025 at 3.04%, 5s of 2029 at 3.02%, 5s of 2034 at 3.19%, 4.25s of 2054 at 4.40% and 5.25s of 2054 at 4.14%, callable 11/1/2034.

J.P. Morgan priced for the Wisconsin Public Finance Authority $120 million of tax-exempt pooled securities, Series 2024-2, Class A certificates, with 4s of 8/2059 with a mandatory put date of 8/1/2027 at 4.30%, noncall.

Volume is $266 billion year-to-date, with the pace of issuance the fastest since at least 2013, according to data from Municipal Market Analytics.

However, most of the issuance in 2024 is front-loaded ahead of the November election, Huffman said.

Furthermore, COVID-era stimulus is “working its way through” municipalities as the funds are drying up, she said.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 2.88% and 2.85% in two years. The five-year was at 2.75%, the 10-year at 2.80% and the 30-year at 3.68% at 3 p.m.

The ICE AAA yield curve was narrowly mixed: 2.90% (unch) in 2025 and 2.87% (+1) in 2026. The five-year was at 2.77% (+1), the 10-year was at 2.80% (unch) and the 30-year was at 3.67% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was narrowly mixed: The one-year was at 2.90% (-1) in 2025 and 2.88% (unch) in 2026. The five-year was at 2.77% (-1), the 10-year was at 2.82% (+2) and the 30-year yield was at 3.67% (+3) at 3 p.m.

Bloomberg BVAL was bumped two to five basis points: 2.89% (-5) in 2025 and 2.84% (-4) in 2026. The five-year at 2.75% (-5), the 10-year at 2.76% (-2) and the 30-year at 3.65% (-3) at 3:30 p.m.

Treasuries were firmer five years and out.

The two-year UST was yielding 4.442% (+3), the three-year was at 4.260% (+1), the five-year at 4.142% (-1), the 10-year at 4.255% (-2), the 20-year at 4.592% (-3) and the 30-year at 4.499% (-4) at 3:30 p.m.

GDP

Gross domestic product came in stronger than expectations, but economists say weakness is ahead, while some noted the headline figure exaggerated economic strength.

“GDP came in significantly stronger than anticipated, with most of the surprise coming from building inventories and a pickup in personal consumption,” said Matt Peron, global head of solutions at Janus Henderson Investors.

While two revisions to the data remain, he said, the report “does lend support to the soft-landing narrative, which is our base case.”

The solid report, Peron said, “should provide some relief to stressed markets,” but “the economy does seem to be downshifting and that may cause continued volatility in the coming months.”

While “details of the report were pretty solid,” Scott Anderson, chief U.S. economist and managing director at BMO Economics, said, “the headline figure exaggerates the strength of the economy, as a strong inventory increase padded the numbers. Real final sales rose 2.0% annualized, up just a bit from the first quarter’s 1.8% pace.”

The report “does little to change our view that economic activity is indeed about to downshift into a below potential path in the second half of the year,” Anderson said, noting lackluster earnings reports, signs of consumers tiring and expected slowness in business capital investment.

“Election and fiscal policy uncertainty will likely add to the malaise until businesses get more clarity about the future path of tax and spending policies of the federal government and the shape of the economic slowdown,” he said.

The report shows the “economy powered through the perception of a second quarter slowdown,” said Olu Sonola, Fitch Ratings’ head of economic research. He was surprised “the contraction in durable goods consumer spending during the first quarter was completely reversed during the second quarter.”

After a scare in the first quarter, it appears inflation is “back to the 2% glide path,” Sonola said. “This is a perfect report for the Fed: growth during the first half of the year is not too hot, inflation continues to cool and the elusive soft-landing scenario looks within reach.”

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, was most interested in the personal consumption expenditures price index, which gained 2.9%, compared to expectations of 2.7%.

“This is a key metric in predicting the Federal Reserve’s next steps when it comes to interest rate policy,” she said. “While this is higher than target, it is falling and, coupled with a robust economic growth figure, it lessens the pressure on the Federal Reserve to cut rates next week.”

Still, “investors should expect continued volatility for both equity markets and bonds, and that the biggest drivers of U.S. stock pricing will continue to be tech stocks and Federal Reserve policy — or expectations of policy change,” Wall said.

“Business surveys certainly point to a weakening outlook with [Thursday’s] numbers not swaying the market from their belief in a September Fed rate cut,” said ING chief international economist James Knightley.

The report “reaffirms that domestic demand is slowing but remains solid,” said Morgan Stanley economists. “We think continued progress on inflation will give the Fed confidence to cut in September, while moderation in domestic demand and payrolls will keep the Fed on a consecutive cutting cycle through mid-2025.”

Gary Siegel contributed to this article.