Short-term munis were slightly firmer Thursday as muni mutual funds saw continued inflows and the primary market slowed. U.S. Treasuries yields rose and equities sold off.

The two-year muni-to-Treasury ratio Thursday was at 64%, the three-year at 66%, the five-year at 68%, the 10-year at 67% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 68% and the 30-year at 83% at 3:30 p.m.

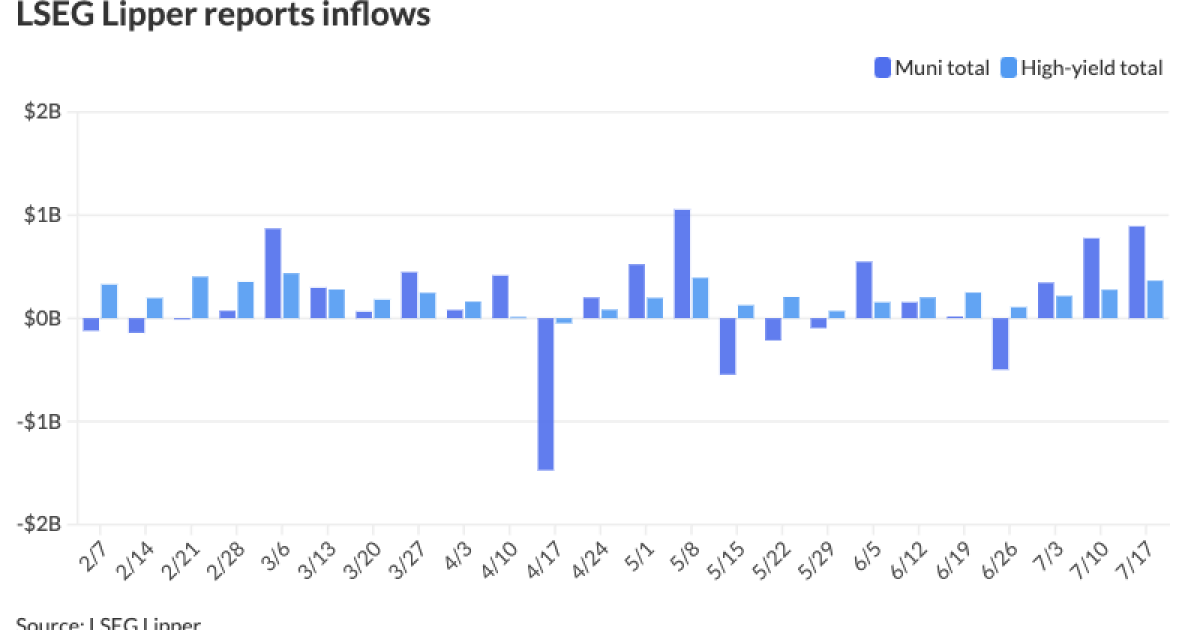

Municipal bond mutual funds saw inflows as investors added $891.4 million to funds after

High-yield continued to show strength, with inflows of $364.4 million after $276.4 million of inflows the previous week.

The outlook for munis “improved significantly” throughout the second quarter, said GW&K Investment Management strategists.

Absolute yields finished June “at the top end of their long-range averages,” while relative value ratios “have finally eased off ultra-tight levels, providing more cushion against Treasury volatility going forward,” they said.

Credit fundamentals should be “resilient” even if there is “some economic slowing, with conservative budgeting practices supported by record-high reserves,” GW&K strategists said.

In the near-term, there may be “strength from the typical summer blend of elevated reinvestment flows and tapering issuance,” they noted.

July is usually the strongest-performing month of the year, said BlackRock’s Patrick Haskell, James Schwartz and Sean Carney.

While some performance may have been “pulled forward into June,” there are several reasons for “continued strength,” they said.

“Interest rates tend to be supportive during the summer months, yields remain attractive and should continue to entice retail buyers, and supply is entering the most seasonally favorable period of the year,” they said.

There’s has been a lot of issuance in “high-quality” in 2024 as the market absorbs the money coming in, said Craig Brandon, co-head of muni investments at Morgan Stanley Investment Management.

Given the amount of issuance, he said, it’s unsurprising that market indices are essentially flat year-to-date.

“That’s not a bad sign because the volume of issuance has been very high,” Brandon said, noting there is more of a supply/demand imbalance in the high-yield space.

After two days of a busy primary market, issuance slowed Thursday.

Morgan Stanley priced for the San Francisco Public Utilities Commission (Aa2/AA//) $624.615 million of wastewater revenue bonds. The first tranche, $539.72 million of green SSIP bonds, 2024 Series C, saw 5s of 10/2027 at 2.69%, 5s of 2029 at 2.70%, 5s of 2031 at 2.71%, 5s of 2039 at 3.10%, 5s of 2044 at 3.44%, 5s of 2049 at 3.66% and 5s of 2054 at 3.77%, callable 10/1/2034.

The second tranche, $84.895 million of non-SSIP bonds, 2024 Series D, saw 5s of 10/2027 at 2.69%, 5s of 2029 at 2.70%, 5s of 2031 at 2.71%, 5s of 2039 at 3.10%, 5s of 2044 at 3.44%, 5s of 2049 at 3.66% and 5s of 2054 at 3.77%, callable 10/1/2034.

BofA Securities priced for the Metropolitan Transportation Authority (/AA/AA/) $389.76 million of climate bond certified dedicated tax fund green bonds, Series 2024A, with 5s of 11/2025 at 2.88%, 5s of 2029 at 2.85%, 5s of 2034 at 3.05%, 5s of 2039 at 3.32%, 5s of 2044 at 3.68%, 5s of 2049 at 3.93% and 5.25s of 2054 at 3.97%, callable 11/15/2034.

In the competitive market, Santa Clara County, California, (/AAA/AAA/) sold $350 million taxable Election of 2016 GOs, 2024 Series C, to J.P. Morgan. Pricing details were not available at 3:30 p.m.

Volume will remain sizable for the next few weeks, with several large deals already on tap.

The Texas Transportation Commission is set to price July 23 $1.7 billion of Central Texas Turnpike System first tier and second tier revenue refunding bonds.

The Port of Seattle is set to price the week of July 22 around $850 million of intermediate lien revenue and refunding bonds.

New York City is set to price the week of July 29 $1.2 billion of GO refunding bonds.

The Minneapolis-St. Paul Metropolitan Airport is set to price July 24 $701 of subordinate airport revenue bonds.

The Long Island Power Authority is set to price the week of August 5 $1.1 billion of electric system general revenue bonds.

The South Carolina Public Service Authority is set to price $900 million of revenue obligations.

Meanwhile, money market funds have yet to see large inflows, Brandon said.

For the six-day period ending July 10, money market funds decreased by $10.301 million to $6.144 billion, according to the Investment Company Institute.

Market participants will eventually decide they want to take some risk again, particularly duration risk, he noted.

“When that happens, the municipal market will get its share of flows out of those money market funds,” Brandon said.

Some money is already leaving the “short part” of the market and entering the “long part,” he said.

Once the Federal Reserve starts “making some moves,” market participants will move money out of money market funds and into a little more risk product, Brandon said.

GW&K strategists noted there is reason for caution.

“The long end of the curve has flattened substantially, squeezing out some of the extra yield and roll that had been available over the last few quarters,” they said.

And while fundamentals are “unambiguously positive,” there has been a substantial compression of spreads, “reducing the potential for gains from further tightening,” GW&K strategists said.

Furthermore, with the November election approaching, there could be increased volatility and “headline-driven pullbacks,” they said.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.88% (-2) and 2.86% (-2) in two years. The five-year was at 2.77% (unch), the 10-year at 2.78% (unch) and the 30-year at 3.66% (unch) at 3 p.m.

The ICE AAA yield curve was mixed: 2.88% (-5) in 2025 and 2.88% (-1) in 2026. The five-year was at 2.76% (+1), the 10-year was at 2.79% (+1) and the 30-year was at 3.63% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped one to three basis points: The one-year was at 2.95% (-3) in 2025 and 2.92% (-2) in 2026. The five-year was at 2.78% (-1), the 10-year was at 2.78% (-1) and the 30-year yield was at 3.63% (-1) at 3 p.m.

Bloomberg BVAL was little changed: 2.94% (-1) in 2025 and 2.88% (-1) in 2026. The five-year at 2.80% (unch), the 10-year at 2.78% (unch) and the 30-year at 3.67% (unch) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.472% (+4), the three-year was at 4.241% (+4), the five-year at 4.118% (+5), the 10-year at 4.201% (+5), the 20-year at 4.521% (+5) and the 30-year at 4.418% (+5) at 3:30 p.m.