Geopolitical turmoil roiled markets Friday, sending investors on a flight-to-safety trade into U.S. Treasuries while equities sold off after news reports that Israel was bracing for an attack by Iran on government targets and that China was providing Russia with drone and missile components.

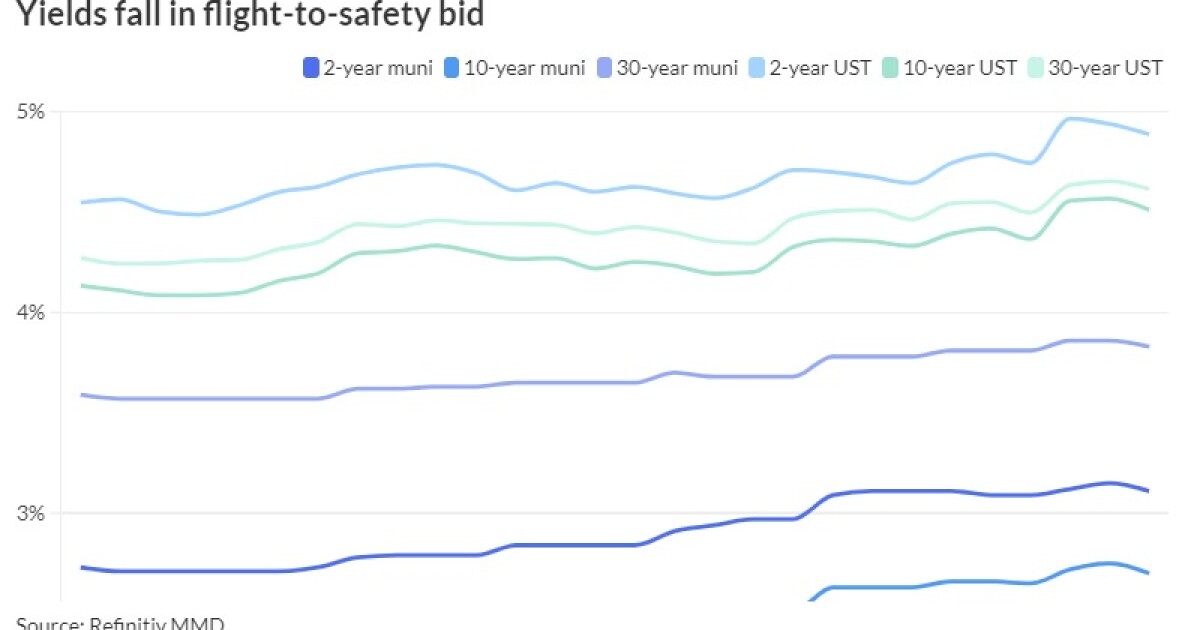

Municipal bonds followed USTs as yields fell in both asset classes as investors continue to digest to a ever-changing global macroeconomic and geopolitical picture.

Triple-A yields fell two to eight basis points, depending on the curve, while UST yields fell four to seven basis points with the largest gains on the short end.

The two-year muni-to-Treasury ratio Friday was at 64%, the three-year at 62%, the five-year at 59%, the 10-year at 59% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 63%, the three-year at 61%, the five-year at 59%, the 10-year at 60% and the 30-year at 82% at 3:30 p.m.

In a week marked by inflation and jobs data that made clearer the Federal Reserve will not be cutting rates nearly as much or as many times as some had expected even a week ago, Friday’s headlines further complicated the landscape for investors and munis have had little choice but to go along for the ride.

“Market expectations about Fed rate cuts have been a bit of a roller coaster in 2024: we started the year expecting six cuts or more this year, but because of the stronger economy and stickier inflation, we are nearly back to last October’s expectations, and Treasury yields are also in the same zip code after this week’s sell-off,” noted Barclays PLC in a weekly report. “On the back of the stronger inflation data, Barclays’ economists have changed their FOMC call, and now expect just one 25bp rate cut this year, likely in September (versus three rate cuts previously).”

Barclays said that as rate volatility is likely to continue, they “remain cautious.”

“In our view, tax-exempts will likely underperform in the near term, but we don’t think that this underperformance will be dramatic, as market technicals are much stronger, and higher yields will likely result in more robust fund inflows,” Barclays strategists Mikhail Foux and Clare Pickering wrote. “Meanwhile, credit spreads still have some room to tighten although not that much, and we also see the front end of the tax-exempt curve performing better, as the 3s5s and 5s10s slopes are about 10bp more inverted than last October.”

BofA Global Research noted that compared to the volatility in USTs, the atmosphere in the muni market is “somewhat less anxious … as the selloff is well within the scope of expectations.”

Municipals are in the red at -0.96% so far in April and -1.34% year-to-date while USTs are in the red at -1.87% in April and -4.71% year to date while corporates are in the red at -2.01% in April and -2.40% year to date.

“In our judgment, there is approximately 10bp or so of additional yield rise before the selloff is complete,” BofA said. ”This is the time to pick and choose bonds, and if the 10bp or so becomes available, investors should enter the market in anticipation of a bullish shift sometime in May.”

Investors will be greeted with a $7.216 billion new-issue calendar to digest, with $5.409 billion of negotiated deals on tap and $1.807 billion of competitive sales.

Florida (Aa3/AA/AA/AA/) leads the negotiated calendar with $1.5 billion of taxable State Board of Administration Finance Corp. revenue bonds in a sale led by Morgan Stanley.

In the competitive market, the Virginia College Building Authority (Aa1/AA+/AA+/) is set to sell $301.805 million of 21st Century College and Equipment Programs educational facilities revenue bonds and $337.900 million of 21st Century College and Equipment Programs educational facilities revenue bond Tuesday.

AAA scales

Refinitiv MMD’s scale was bumped three to five basis points: The one-year was at 3.34% (-4) and 3.11% (-4) in two years. The five-year was at 2.70% (-5), the 10-year at 2.67% (-5) and the 30-year at 3.83% (-3) at 3 p.m.

The ICE AAA yield curve was bumped one to three basis points: 3.35% (-1) in 2025 and 3.11% (-2) in 2026. The five-year was at 2.74% (-3), the 10-year was at 2.73% (-3) and the 30-year was at 3.81% (-3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to eight basis points: The one-year was at 3.38% (-8) in 2025 and 3.15% (-5) in 2026. The five-year was at 2.74% (-5), the 10-year was at 2.72% (-3) and the 30-year yield was at 3.82% (-3), according to a 3 p.m. read.

Bloomberg BVAL was bumped up to four basis points: 3.36% (-4) in 2025 and 3.15% (-3) in 2026. The five-year at 2.66% (-4), the 10-year at 2.66% (-4) and the 30-year at 3.84% (-4) at 3 p.m.

Treasuries were better across the curve.

The two-year UST was yielding 4.894% (-7), the three-year was at 4.726% (-7), the five-year at 4.553% (-7), the 10-year at 4.518% (-6), the 20-year at 4.747% (-4) and the 30-year at 4.624% (-4) at the close.

Primary to come

Florida (Aa3/AA/AA/AA/) is set to price Monday $1.5 billion of taxable State Board of Administration Finance Corp. revenue bonds, Series 2024A. Morgan Stanley.

The Board of Regents of the University of Texas System (Aaa/AAA/AAA/) is set to price Tuesday $527.465 million of revenue financing system bonds, Series 2024A. J.P. Morgan.

The New York City Municipal Water Finance Authority (Aa1/AA+/AA+/) is set to price Tuesday $450 million of water and sewer system second general resolution revenue bonds Fiscal 2024 Series CC, consisting of $400 million of Subseries CC-1, serial 2054 and $50 million of Subseries CC-2. Barclays.

The Arizona Board of Regents is set to price Tuesday $380.890 million of Arizona State University system revenue bonds, consisting of $151.745 million of green tax-exempt, Series 2024A, serials 2025-2044, terms 2049, 2054; $168.690 million of tax-exempt bonds, Series 2024B, serials 2025-2044; and $60.455 million of taxable bonds, Series 2024C, serials 2025-2039, term 2045. Wells Fargo Bank.

The Regents (Aa3/AA-//) is set to price Thursday $150.655 million of Arizona State University SPEED revenue bonds, Series 2024. Goldman Sachs.

The Ohio Water Development Authority (Aaa/AAA//) is set to price Tuesday $350 million of Water Pollution Control Loan Fund bonds, consisting of $180.190 million of Series 2024A and $169.810 million of Series 2024B. Goldman Sachs.

The Indiana Housing and Community Development Authority (Aaa//AA+/) is set to price Wednesday $198.945 million of single-family mortgage revenue bonds, consisting of $85.935 million of non-AMT social bonds, 2024 Series B-1; $4.065 million of AMT social bonds 2024 Series B-2; and $108.945 million of taxable social bonds, 2024 Series B-3. J.P. Morgan.

The Washington State Housing Finance Commission (/BBB-//) is set to price Thursday $189.995 million of Radford Court and Nordheim Court Portfolio nonprofit revenue bonds, Series 2024, serials 2028-2039, terms 2044, 2049, 2054, 2059. Barclays.

The Jersey City Municipal Utilities Authority is set to price Tuesday $189.595 million, consisting of $25 million of Series 2024A, serial 2025; $80 million of Series 2024B, serial 2025; $50 million of Series 2024C (Aa3///), serials 2025-2044, terms 2049, 2054; and $35.595 million of Series 2024D (Aa3///), serials 2028-2039, terms 2044, 2049, 2054. Stifel.

The Oklahoma Capital Improvement Authority (/AA-/AA-/) is set to price Thursday $167.900 million of state facilities refunding revenue bonds, consisting of $121.360 million of Series 2024A, serials 2025-2030, and $46.540 million of Series 2024B, serials 2025-2034. RBC Capital Markets.

The Oregon Department of Administrative Services (Aa2/AAA//) is set to price Thursday 147.650 million of tax-exempt Oregon State Lottery revenue refunding bonds, consisting of $92.895 million of 2024 Series A, $29.465 million of 2024 Series and $25.290 million of 2024 Series D. Goldman Sachs.

Wake County, North Carolina, (Aa1/AA+/AA+/) is set to price Thursday $137 million of limited obligation bonds, Series 2024A, serials 2025-2043. Truist.

Competitive

The Leon County-City of Tallahassee Blueprint Intergovernmental Agency (Aa2//AA/) is set to sell Tuesday $121.570 million of sales tax revenue bonds, Series 2024, at 11 a.m. eastern Tuesday.

The Virginia College Building Authority (Aa1/AA+/AA+/) is set to sell $301.805 million of 21st Century College and Equipment Programs educational facilities revenue bonds, Series 2024A, Bidding Group 1, at 10:45 a.m. Tuesday and $337.900 million of 21st Century College and Equipment Programs educational facilities revenue bonds, Series 2024A, Bidding Group 2, at 11:15 a.m. Tuesday.

The Charleston County School District is set to sell $146.005 million of Sales Tax Projects – Phase V GO bond anticipation notes at 11 a.m. Wednesday.

Albuquerque, New Mexico, (/AAA//) is set to sell $111.850 million of GO general purpose bonds, Series 2024A, and GO storm sewer bonds, Series 2024B, at 11 a.m. Thursday.

Jessica Lerner contributed to this report.